Life insurance extends a vital safety net for your dependents in the event of your passing. It offers financial protection by paying out a lump sum to your designatees upon your decease. This resource will delve into the fundamentals of life insurance, illuminating its diverse types, benefits, and how to select the best policy to meet your unique needs.

A key dimension of life insurance is its ability to provide monetary stability to your family, ensuring they can manage costs such as mortgage payments, schooling expenses, and everyday household costs.

It can also be used to mitigate potential debts you may have, providing your family with a financial cushion.

When considering life insurance, it's important to meticulously analyze your existing financial circumstances, including your income, obligations, and any existing debt.

Additionally, think about your long-term financial goals, such as your children's tuition or retirement planning.

By understanding these factors, you can establish the appropriate sum of life insurance that best suits your demands.

ul

liVarious types of life insurance available, each with its own attributes.

li Temporary life insurance offers security for a set period of time.

liWhole life insurance provides lifelong security and often includes a savings component.

Navigating the Mechanics of Life Insurance

Life insurance can seem like a difficult beast to understand, but beneath the exterior lies a system designed to provide financial peace of mind for your loved ones in the event of your demise. To truly harness the power of life insurance, it's essential to grasp its fundamental operations. Firstly, let's explore the various types of life insurance offered in the market.

- Term Life Insurance: This popular type provides coverage for a determined period, such as 10, 20, or 30 years.

- Permanent Life Insurance: This type offers permanent coverage and often features a cash value component that increases over time.

Each type functions differently, with its own set of benefits and drawbacks. By meticulously evaluating your individual needs and financial circumstances, you can determine the type of life insurance that best suits your needs.

Decoding Life Insurance: Policy Details, Expenses & Perks

When preparing for tomorrow, life insurance can provide a financial cushion. This comprehensive guide will illuminate the basics of life insurance, including types of coverage, associated costs, and the major benefits it offers.

- Starting with, let's understand the various kinds of life insurance available. Term life insurance provides coverage for a limited duration, while Universal life insurance offers lifelong coverage.

- Following this, we'll analyze the factors that influence the expense of life insurance. Your age, health condition, lifestyle choices, and the amount of coverage desired all factor in.

- Finally, we'll emphasize the numerous benefits that life insurance can deliver. These include protection against financial hardship in the event of your passing, as well as potential benefits.

{Choosing the right life insurance policy is a crucial decision. By understanding the different types of coverage, costs involved, and benefits offered, you can make an informed choice.

How Life Insurance Works: Safeguarding Your Loved Ones

Life insurance is a safety net designed to provide financial assistance to your dependents in the event of your untimely demise. It works by creating a policy with an insurance company where you make regular contributions. In exchange, the company guarantees to pay a lump sum of money known as the death benefit to your beneficiaries upon your death. This financial support can be used to cover liabilities such as mortgage payments, funeral costs, and everyday obligations, ensuring your loved ones' financial well-being even in your absence.

- Consider different types of life insurance to discover the best fit for your situation.

- Shop around and contrast quotes from multiple insurance companies to get the most favorable rates.

- Analyze your policy periodically to ensure it still fulfills your goals.

Essentials of Life Insurance: What You Need to Know

Life insurance can website seem complex, but understanding the fundamental concepts is crucial for making informed decisions about your financial future. It serves as a safety net for your loved ones if you pass away, providing them with monetary support to cover expenses and maintain their lifestyle. There are two primary types of life insurance: term life and permanent life.

Term life insurance provides coverage during a specific period, typically 10, 20, or 30 years. It's a budget-friendly option for individuals who need temporary protection, such as during their mortgage term or while raising young children. Permanent life insurance, on the other hand, offers lifelong coverage and often includes a cash value component. This allows your policy to increase in worth and can be accessed through loans or withdrawals.

When choosing a life insurance policy, consider factors such as your age, the amount of coverage you need, and your budget. It's important to review quotes from different insurers to find the best rate.

Ultimately, life insurance is an essential tool for securing your family's financial well-being.

Determining the Right Life Insurance: A Step-by-Step Process

Securing the suitable life insurance policy can seem like a daunting task, but by following a systematic approach, you can make an informed choice. Begin by analyzing your economic needs and factors. Consider your loved ones, outstanding debts, and future expenses. Next, calculate the coverage of life insurance that would sufficiently meet these needs.

Explore numerous types of life insurance policies, such as term life and permanent life. Each form offers distinct advantages. Carefully contrast the rates, coverage options, and agreement terms of various insurers.

Consult quotes from several reputable insurance providers. Don't hesitate to inquire about any questions you may have. Once you have a clear grasp of the available options, opt for the policy that best aligns your individual requirements.

Marla Sokoloff Then & Now!

Marla Sokoloff Then & Now! Shane West Then & Now!

Shane West Then & Now! Freddie Prinze Jr. Then & Now!

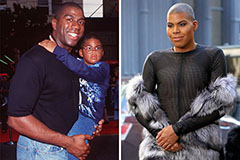

Freddie Prinze Jr. Then & Now! Earvin Johnson III Then & Now!

Earvin Johnson III Then & Now! Robin McGraw Then & Now!

Robin McGraw Then & Now!